My experience of a credit card fraud and why I don't like credit cards!!!

I have been using Axis card for more than five years when subjected to a fraud. The brief details are like this -

On 16th June2020, I received a call from a fraudster introducing herself as an Axis bank employee. She said I have some leftover credit points , which indeed as few days back I had checked that some credit points are leftover. She recited most of my credit card data and tricked me to reveal the OTPs. But two peculiar things - i received message for debit - i.e 40k amount debited to "Nobroker" and when I checked the same time on internet banking no transaction was shown. The fraudster convinced me that "Nobroker" means No broker and amount is debited by the bank for time being and hence it is not showing on internet banking. Finally I came out of the fraudster plan after 24 hours and then I blocked my credit card.

Action taken -

- Lodged complaint to axis bank to take action on fraud - by email, mobile.

- Bank had blocked the card and done nothing else. They will not do . But if you want a personal loan , one agent will knock your door - just the next day.

- Lodged online complaint on cyber crime portal of GOI.

- Lodged FIR with Cyber crime police.

- Chased bank - but after 45 days bank says - Customer is liable and we have no role. They charged interest on the amount.

- Paid everything and asked the bank to close my credit card which they are yet to do.

Then started real relevation -

- Credit cards are not as safe as you think - most of credit card data are for sale on darkweb - see this article and this.

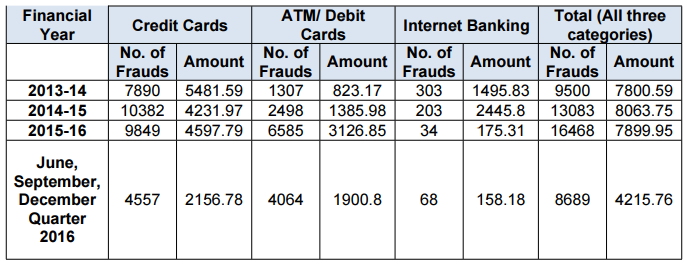

- Seeing the following statistics confirm my belief (even though data is old) that credit cards are more easily subjected to fraud compared to

internet banking and debit card.

Image source - https://ultra.news/s-e/29186/credit-debit-card-fraud-sharply-year-india

Image source - https://ultra.news/s-e/29186/credit-debit-card-fraud-sharply-year-india

- In debit card or internet banking - thief can loot the money you already have in account . But in credit card , the thief can loot the money that is not yours. It is like thief has stolen the money you have taken on loan at a high rate of interest. See this post of Axis Bank on types of credit frauds prevealant in India. Atleast I am glad they are admitting the risk of Fraud with credit cards.

- Banks are least bothered about your loss. Whatever noise you make - they least care. Even RBI is helpless. In my case I tried to buzz the Axis bank many ways without success, approached RBI ombudsman but nothing happened. I atleast wanted the bank to say - "yes we are also required to do something, we are going to take the following steps to avoid future cases.....". Finally I had to pay additional 16,000 /- as interest on the 80K fraud amount. So in total loot is nearly one lakh which i not my money. Revealing OTP I had erred , but I strongly feel being the custodian of customer's money they should immediately try to charge back and if not possible tell the customer in the beginning itself that bank cannot do anything. In my case they took almost 45 days to give a proper reply.

- Don't be under impression that "as online transactions clearly tell where the money has gone - it is easy to catch them". Ask any one who was subjected to online fraud (including me) - it is not just very hard , it is perfectly impossible to get the money back. There are loopholes in the law which fraudsters use to their advantage. And the number of cases are on high - because it is just tough to catch them. Fraudsters operate remotely - and law (police) operates locally. In online frauds - the thief may be sitting 3000 kms away from you and law and order is a state subject. So it requires seamless cross state functioning - which I guess is not in place. The fraudsters have their own networks to move the money. In my case, fraudster used some accounts on No Broker website - which deals with renting properties and then transferred this amount to some accounts in some small finance bank in Bangalore. I submitted all this to Police. But Police have to go by law - they have to lodge the case in court take permission and you know the number of cases courts have with them. So in the end, forget about your money.

- Credit cards are biggest businesses for the banks - the moment you are late on payment - you will be charged almost 2% per month which is the highest interest in banking sector. Credit cards offer the romance of buying what you want without money in your pocket or bank account. It may breed irresponsible spending. And if you feel it helps in emergency - it is better to take Overdraft/personal loan/gold loan/help from friends rather than carrying a loan account all the time.

What I have decided -

- Not to use any credit card. ( I am not advocating any one to close their credit card - but I don't want to carry this loan account in my purse.)

- Better to use Truecaller type apps (no idea how safe these apps are here). Incidentally when i checked on true caller, the mobile number through which i was subjected to fraud - it had shown the number as - Axis bank Fraud.

- Better to rely on internet bank and debit cards.

- Use Payment apps cautiously (as I heard of lot of fraud complaints on payment apps)